tn franchise and excise tax due date

Franchise. Add Schedule A Line 3 and Schedule B Line 7.

Tennessee Franchise Excise Tax Price Cpas

The excise tax is based on net earnings or.

. FE-9 - Extension for Filing the Franchise and Excise Tax Return. The following will cover certain aspects of Tennessees Franchise and Excise tax and give particular focus to the more common exemptions available under the taxing statute. Add Schedule A Line 3 and Schedule B Line 7.

1172022 - Franchise Excise Tax Due Date - Annual filers with Fiscal YE 9302021. In general the franchise tax is based on the greater of Tennessee apportioned. For example a calendar year taxpayers return is due on April 15.

To receive a six month extension a taxpayer must have paid on or before the original due date an amount. Tennessee Department of Revenue. FE-4 - Tennessee Filing Requirement for an LLC that Files Federally as an Individual or Division of a General Partnership.

A voluntary professional association the TBA offers its members a. Learn about excise tax and how Avalara can help you manage it across multiple states. The book value cost less accumulated depreciation of real.

For example a calendar year taxpayers estimated payment are due on April 15 June 15 and September 15 of the current year and January 15 of the next year. 4182022 - Franchise Excise Tax Due Date - Annual filers with Fiscal YE 12312021. This extension will automatically apply.

Under Tennessee law the Commissioner is authorized to extend the deadline for filing a return whenever the IRS extends a federal filing date. 1152021 - Franchise Excise Tax Due Date - Annual filers with Fiscal YE 9302020 1152021 - Franchise Excise Tax Due Date - Annual filers with Fiscal YE. The Tennessee Bar Association is dedicated to enhancing fellowship among members of the states legal community.

However for the tax period ending December 31 2021 the due date is extended to April 18 2022 due to the. The Tennessee Department of. Schedule C Computation of Total Tax Due or Overpayment Line 8.

April 18 2022 Related Links. FE-5 - Due Date for Filing Form FAE170 and Online Filing. May 16 2022 Related Links.

This is the total franchise and excise tax liability. The Franchise Excise Tax return can be extended for six months provided the taxpayer has paid by the original due date at least 90 percent of the current years tax liability or 100 percent. 5162022 - Franchise Excise Tax Due Date - Annual filers with Fiscal YE 1312022.

The department has also extended the franchise and excise tax due date from April 15 2021 to May 17 2021. This is the total franchise and excise tax liability. No further action is required.

The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee. Net worth assets less liabilities or. January 17 2022 Related Links.

Other percentage taxes are indirect taxes that can be passed on by person required to pay to another person who shall bear the burden of paying the tax. Schedule C Computation of Total Tax Due or Overpayment Line 8. Franchise.

Ad Find out what excise tax applies to and how to manage compliance with Avalara. If you have questions about Franchise And Excise Tax Online contact.

Tennessee Cpa Journal May June 2015

Tax Deadline 2020 When Are My State Taxes Due Amid Coronavirus

Federal And Tennessee Tax Calendar Compass East

Form Fae 173 2007 Fill Out Sign Online Dochub

Fillable Online Tn Tennessee Application Exemption Franchise Excise Taxes Form Fax Email Print Pdffiller

2021 Tax Filing Deadline Extension

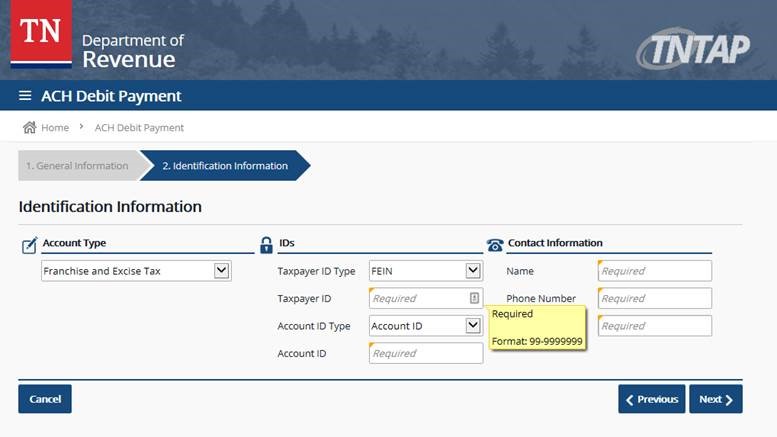

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Covid 19 Tn Department Of Revenue Extends Certain Tax Deadlines Ucbj Upper Cumberland Business Journal

Tennessee Clarifies The Application Of Marketplace Facilitator Legislation To Franchise Excise Tax Forvis

How To Form An Llc In Tennessee Llc Filing Tn Swyft Filings

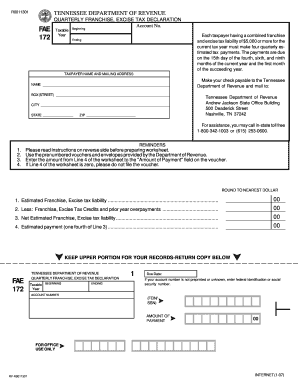

Fae 172 Form Fill Out And Sign Printable Pdf Template Signnow

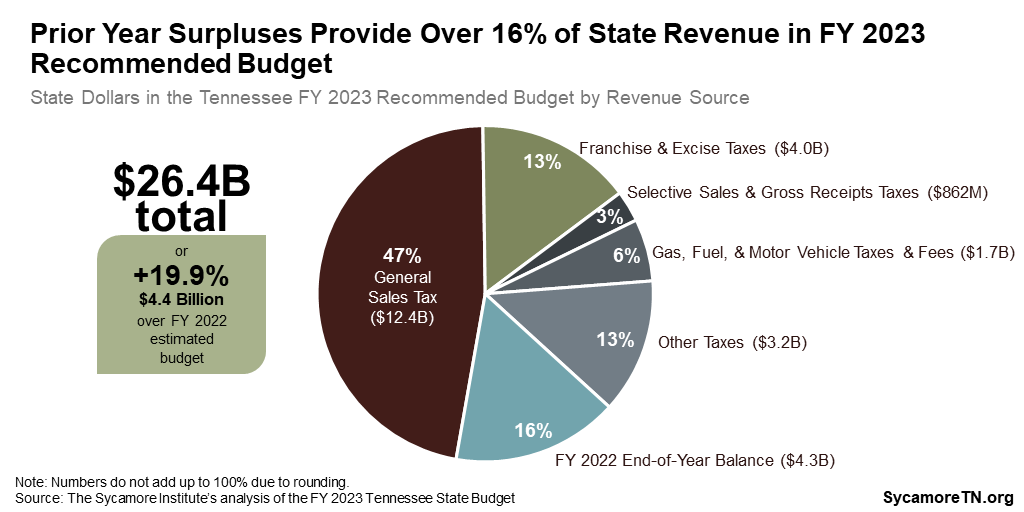

Summary Of Tennessee Gov Lee S Recommended Fy 2023 Budget

Fae 173 Instructions Fill Online Printable Fillable Blank Pdffiller

Tennessee Extends Certain Tax Deadlines Due To Covid 19 Ucbj Upper Cumberland Business Journal

Franchise And Excise Tax Hall Income Tax Crosslin

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Tn Dept Of Revenue On Twitter Reminder 2017 Hall Income Tax Amp Franchise And Excise Tax Due Tomorrow Go To Tntap Https T Co Ieyohtca37 To File And Pay Servingtn Tnrevenue Https T Co Tltkcb4zb0 Twitter